Wage types

21.ABASALARY

Monthly or hourly wages: create a complete payroll including family allowances easily.

Wage types

21.ABASALARY

Monthly or hourly wages: create a complete payroll including family allowances easily.

Quick. Easy. Online.

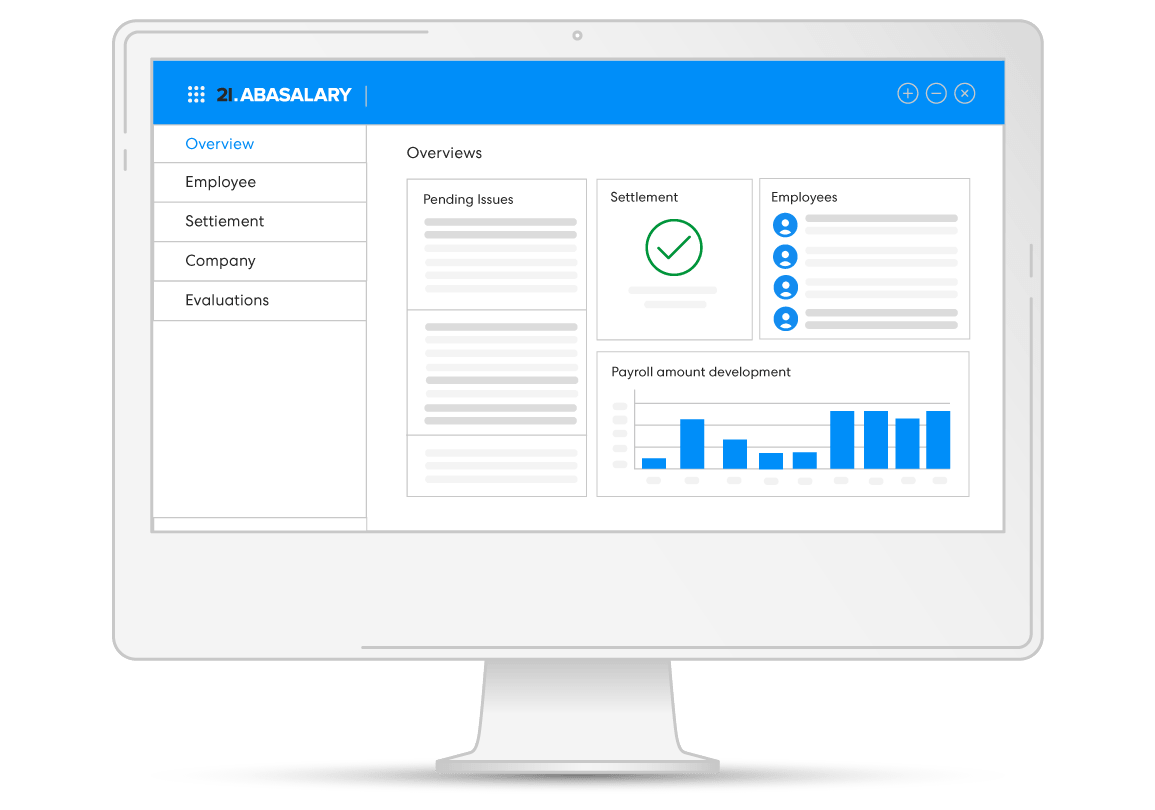

Various payroll types and allowances clearly arranged in an overview.

Welcome to 21.AbaSalary – your tool for easy payroll entry.

Simple use

Watch the video and experience the simplicity for yourself.

Instead of by hand with Word or Excel, you can easily create payroll settlements with 21.AbaSalary. Thanks to an industry-neutral payroll type master, standard payrolls are a breeze. The monthly or hourly wage, including family allowances, is clearly displayed. The payment of insurance daily allowances and short-time work is also very simply handled. If you wish, it is possible to include a business car on the wage statement. Minimum effort, maximum professionalism.

ELM 5.0 certified

21.AbaSalary is the first free ELM 5.0 certified Swiss payroll software! With our software you benefit from the easy and innovative data exchange that meets the security requirements between companies, insurers and authorities.

Overview of functions

The most important functions of 21.AbaSalary at a glance. Thanks to a simple, logical structure and an intuitive tool, processing your payroll settlements is a breeze.

Standard payroll type base

Monthly or hourly wage

13th monthly wage

Family allowance according to cantonal rate

Business vehicle

Settlement of insurance daily allowances and short-time work

Expenses and per diems

Customize designations

FAQs Payroll types

We answer the most frequently asked questions here. Fast and uncomplicated.

Can payroll types also be adjusted?

No, the payroll type master is predefined. For some payroll types, however, the name that is printed on the payroll settlement slip can also be changed.

Can an hourly wage also be charged to employees who receive a monthly salary?

All employees must be assigned to a payroll type. In certain constellations, however, an hourly payroll type can also be assigned to a monthly wage earner.

What are the payment dates for the 13th monthly wage?

For monthly wage earners, the payment month can be freely chosen. For hourly wage earners, monthly payment is also possible. For employees without a 13th monthly wage, the calculation can be deactivated.

How can the share fro private use be accounted for in the case of a business vehicle?

In the personnel master, only the details of the purchase price and any participation in the costs must be entered. The necessary payroll types are then automatically calculated and later shown on the payroll settlement.

Is there an industry-specific payroll type master?

Currently, we only offer a sector-neutral payroll type master. In the future, sectors with a payroll type master will also be covered.

Help & Support

Frequently asked questions, knowledge base articles and tutorials can be found in our Help Centre. Our dedicated support team and experts are happy to answer any further questions you may have.