Das wichtigste zur Quellensteuer in der Schweiz

Das wichtigste zur Quellensteuer in der Schweiz Auf Bundesebene hat die Schweizerische Eidgenossenschaft ihre eigenen Steuervorschriften, die...

Swiss21 ist Ihre Lösung für die Verwaltung Ihres Unternehmens.

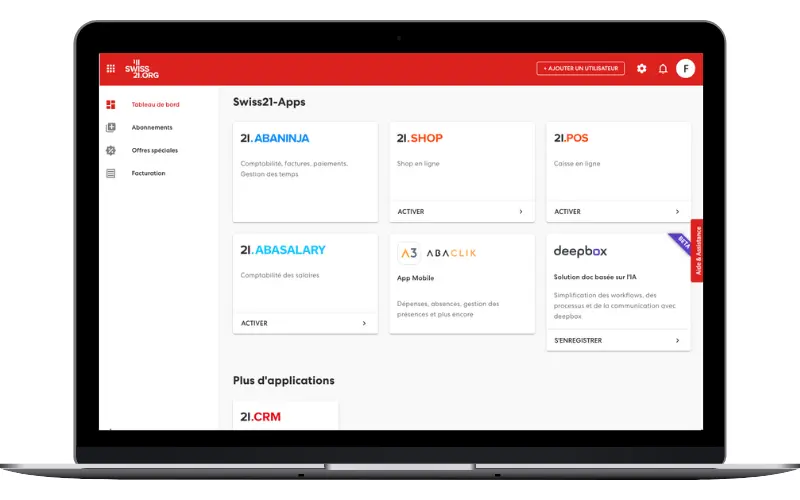

Swiss21 ist ein ERP-System für Schweizer KMUs, Klubs und Gesellschaften. Mit unserer Plattform können Sie kostenlos mit der Digitalisierung Ihres Unternehmens beginnen und diese wird Ihnen enorm viel Zeit ersparen. Wir bieten ein Rechnungsprogramm mit automatischer Buchhaltung, ein Lohnprogramm, ein E-Commerce, ein CRM sowie eine mobile Anwendung für die Verwaltung von Spesenabrechnungen an. Erfahren Sie mehr in unserem kurzen Video!

Willkommen bei Swiss21 – wo wir Ihnen helfen, Ihren Arbeitsalltag zu vereinfachen und Zeit zu sparen. Unsere Cloud-Software bietet zahlreiche Applikationen, die auf Ihre spezifischen Bedürfnisse zugeschnitten sind. Lassen Sie uns Ihnen zeigen, was Swiss21 alles kann:

Erfahren Sie, wie unsere All-in-One-Lösung die Verwaltung Ihres Unternehmens

erleichtert und Ihnen hilft, häufige Hindernisse und Probleme zu überwinden.

Reduzieren Sie Ihre Arbeitsbelastung durch die Automatisierung sich wiederholender Verwaltungsaufgaben. Das heisst mehr Zeit für Ihre Kunden.

Vermeiden Sie hohe Softwarekosten! Bei Swiss21 sind alle Programme in einer Plattform miteinander verbunden. Der Start ist einfach und kostenlos!

Swiss21 wurde für alle entwickelt. Sie müssen kein Experte für die Nutzung sein. Innerhalb von 5 Minuten sind Sie startklar und können Ihr Unternehmen einrichten.

Schützen Sie Ihre sensiblen Informationen mit unserem in der Schweiz gehosteten Cloud ERP-System, das den Schweizer Standards entspricht.

Entdecken Sie die beeindruckenden Zahlen, die unser Engagement für den Erfolg unserer 60.000 Kunden belegen. Wir sind stolz darauf, dass unsere Kunden auf uns zählen können, um ihre Ziele zu erreichen.

Unser Engagement für Qualität und den Erfolg unserer Kunden ist zentral für die Zufriedenheitsrate von 95%.

Schweizer KMU, Vereine und Start-ups vertrauen bereits auf unsere Software-Lösungen für die Unternehmensverwaltung

Bewertungspunkte auf Google unterstreicht die Zufriedenheit unsere Nutzerinnen und Nutzer.

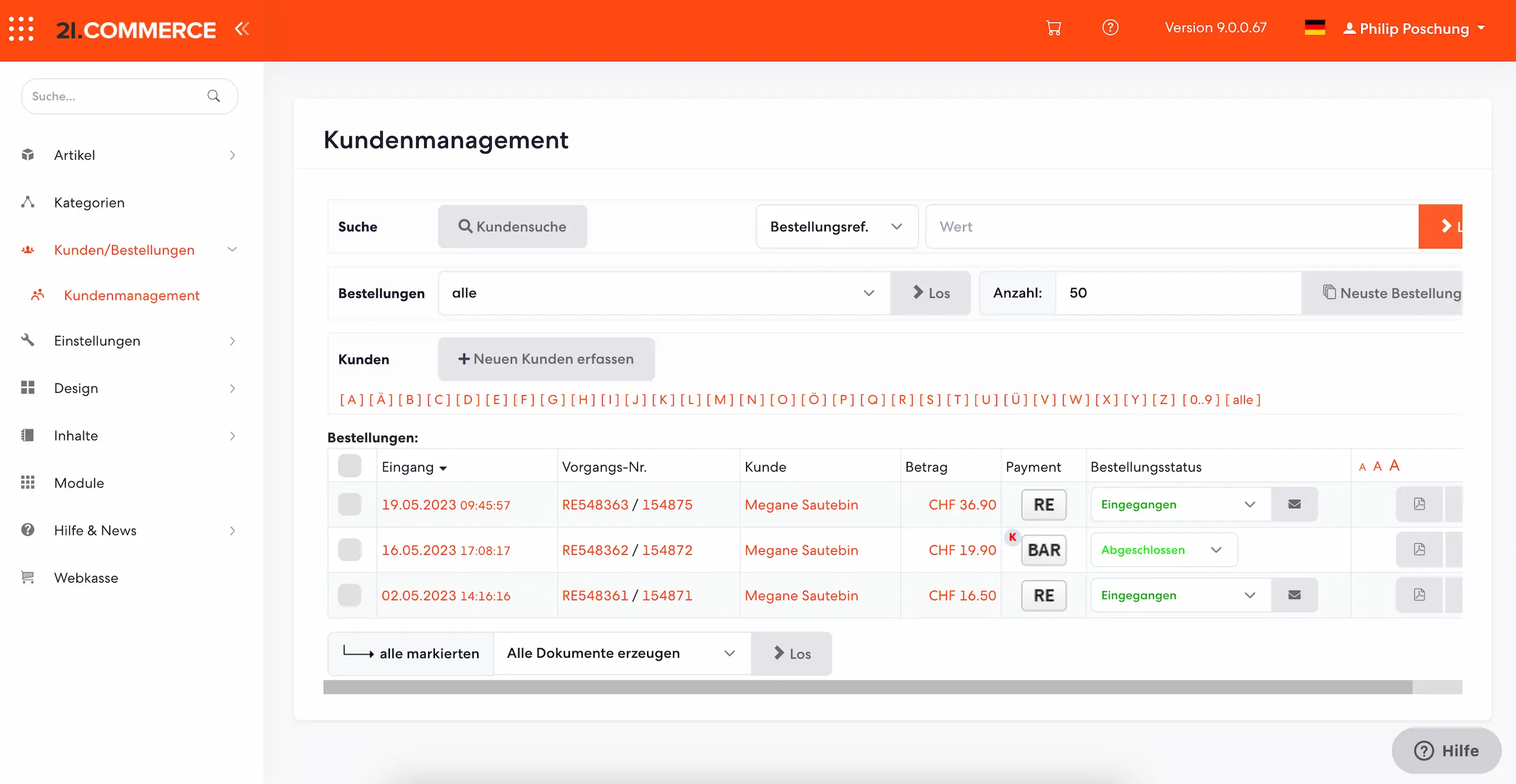

Erfahren Sie, wie unsere integrierten und benutzerfreundlichen Lösungen die Verwaltung Ihres Unternehmens revolutionieren und Ihnen helfen können, Ihre Ziele schneller zu erreichen.

Traditionelle, nicht-digitale Firmen verbringen oft unzählige Stunden mit manueller Dateneingabe, Papierkram und komplexen Excel-Tabellen. Dies führt zu Fehlern und Inkonsistenzen. Zudem benutzen Schweizer KMUs oft getrennte Systeme und dies führt zu Informationsinseln und ineffizienter Kommunikation. Danke Swiss21 brauchen Sie keine weiteren Systeme, Sie können alles an einem einzigen Ort erledigen. Erleben Sie einen nahtlosen Übergang zur digitalen Effizienz mit Swiss21.

Traditionelle, nicht-digitale Firmen verbringen oft unzählige Stunden mit manueller Dateneingabe, Papierkram und komplexen Excel-Tabellen. Dies führt zu Fehlern und Inkonsistenzen. Zudem benutzen Schweizer KMUs oft getrennte Systeme und dies führt zu Informationsinseln und ineffizienter Kommunikation. Danke Swiss21 brauchen Sie keine weiteren Systeme, Sie können alles an einem einzigen Ort erledigen. Erleben Sie einen nahtlosen Übergang zur digitalen Effizienz mit Swiss21.

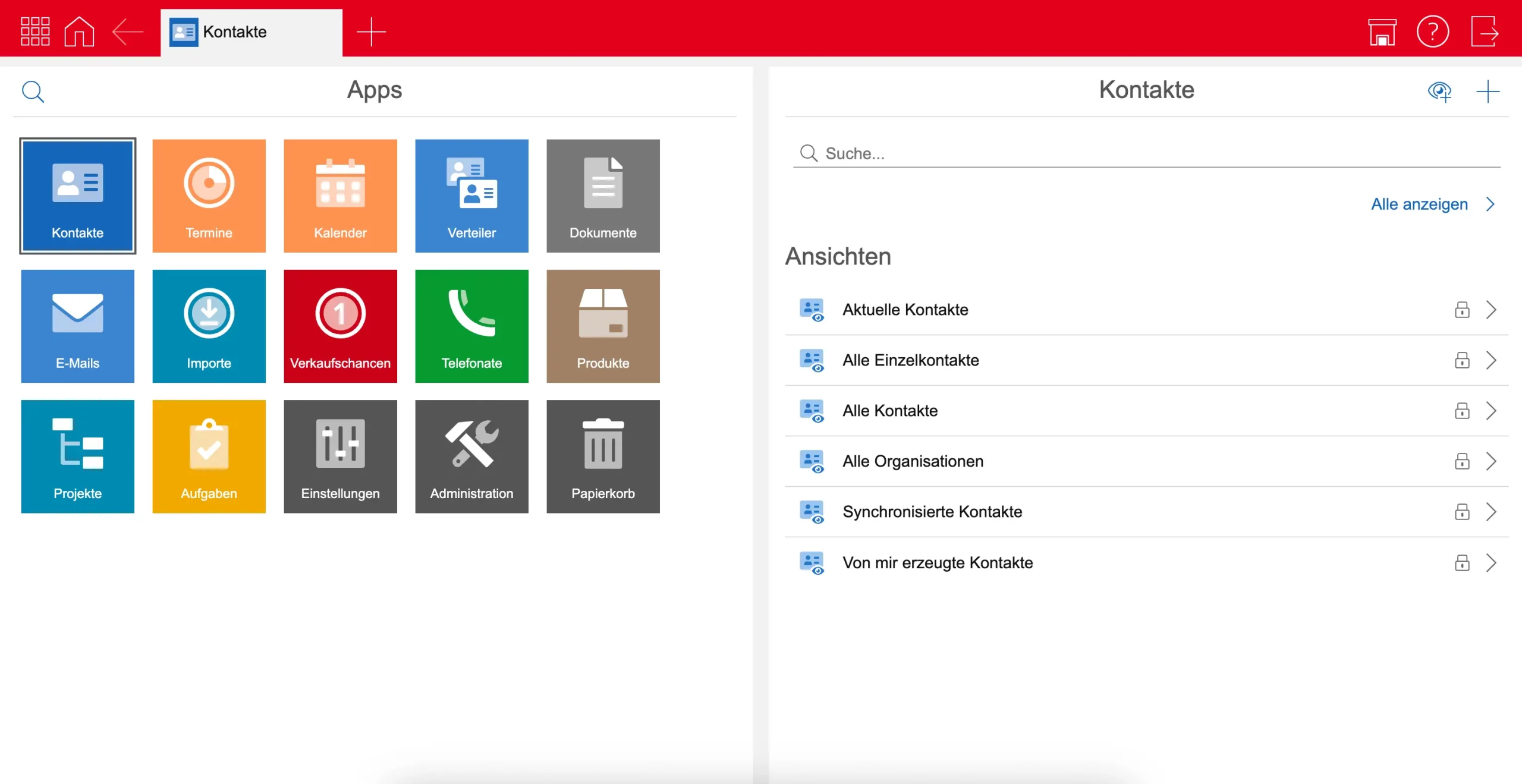

Sie müssen kein Experte sein, um Ihre Administration zu verwalten. Mit Swiss21 kann es jeder schaffen!

Nutzen Sie unseren kostenlosen Support, um Ihr Konto einzurichten oder wenn Sie Fragen zu unserer Plattform haben.

Dank der Automatisierung von Buchungen und unseren verschiedenen Eingabemasken sparen Sie Zeit bei Ihrer Verwaltungsarbeit.

Arbeiten Sie von überall und zu jeder Zeit. Alle Ihre Unterlagen befinden sich in der Cloud und sind jederzeit zugänglich.

Sie müssen kein Experte sein, um Ihre Administration zu verwalten. Mit Swiss21 kann es jeder schaffen!

Nutzen Sie unseren kostenlosen Support, um Ihr Konto einzurichten oder wenn Sie Fragen zu unserer Plattform haben.

Dank der Automatisierung von Buchungen und unseren verschiedenen Eingabemasken sparen Sie Zeit bei Ihrer Verwaltungsarbeit.

Arbeiten Sie von überall und zu jeder Zeit. Alle Ihre Unterlagen befinden sich in der Cloud und sind jederzeit zugänglich.

Als Swiss21-Kunde profitieren Sie von unserer Zusammenarbeit mit starken Partnern.

Entdecken Sie unsere neuesten Artikel, die sich mit Management, Buchhaltung, Gehältern oder

dem aktuellen Finanzgeschehen in der Schweiz beschäftigen.

Das wichtigste zur Quellensteuer in der Schweiz Auf Bundesebene hat die Schweizerische Eidgenossenschaft ihre eigenen Steuervorschriften, die...

Schweizer Mindestlohn In der Schweiz gibt es einen staatlich vorgeschriebenen Mindestlohn, der von keinem Arbeitnehmer unterschritten werden...

Arbeitszeugnis erstellen 19. Mrz. 2021 | 21.AbaSalary, How-to, Personal Vielen Arbeitnehmer:innen ist es beim Lesen eines Arbeitszeugnisses schon einmal so gegangen:...